The insurance industry is a major contributor to New York State’s economy and communities–providing financial security to consumers and businesses and vital services to people in their time of need. Let’s take a look at the numbers!

76.9 Billion in Economic Output

The insurance industry’s contributions to the New York State economy accounted for 3.5% of the state’s gross domestic product. Insurance contributed more than other key industries, including construction and utilities.1

$23.9 Billion in Municipal Bonds

Insurance companies invest the premiums they collect in state and local municipal bonds, helping to fund the building of roads, schools and other public projects.5

$2.5 Billion in Taxes

Premium taxes paid by insurance companies in New York State totaled $2.5 billion in 2023, in addition to numerous other taxes, assessments and fees.2

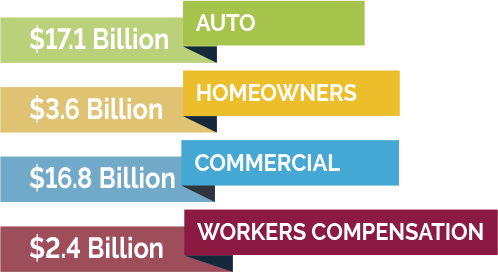

$39.9 Billion in Claims

Insurance provides New Yorkers with financial security and enables people to live life to the fullest. Individuals would not be able to own a home, drive a car or start a business without insurance.3

$1.3 Billion in Charity

By donating financially to a myriad of worthy causes, New York insurance companies and agents contribute $1.3 billion in philanthropic giving annually on a national level. Even more importantly, employees dedicate their time to help those in need—whether it’s Meals on Wheels, flood recovery efforts or building a playground—the industry is always looking to make a difference.4

149,600 Jobs

New York boasts one of the largest insurance workforces in the country. The Empire State is ranked fourth in the nation.6

Employing New York

Insuring New York

Moving New York Forward

1. U.S. Bureau of Economic Analysis, 2023 2. U.S. Department of Commerce, 2023 3. S&P Global, 2023 4. Insurance Industry Charitable Foundation, 2024 5. A.M. Best, 2015 6. U.S Bureau of Economic Analysis, 2023